If you’re trying to get your head around your business’ numbers – *excuse us while we enthusiastically cheer you on* – you might have come across the words “cash vs accrual accounting” or reporting on a “cash basis vs accrual basis”.

While those words might sound boring AF, they are super important for business owners to understand. Which is why I’m here to explain it all to ya, in a super simple “ahhhh, I totally get ya Sum” kinda way.

Ready friend? Here’s the download.

The difference between cash vs accrual

When you see or hear the words “cash basis” or “accrual basis”, what’s being talked about is the way you report on your financial performance (aka the money going in and the money coming out of your business).

The difference squarely comes down to timing – do you record money coming in and going out on the day you pay the bill or receive a payment? Or do you record it on the day listed on the bill or the day you create a customer’s invoice?

In super simple terms:

What is cash basis accounting?

Despite how it sounds, “cash accounting” or reviewing your finances on a “cash basis” has nothing to do with being paid in cash. It simply means you’re reporting on your income and expenses when money changes hands (aka when it hits or leaves your bank account).

What is accrual basis accounting?

As you might’ve guessed, on the other side of the fence we have “accrual accounting” or reviewing your finances on an “accrual basis”.

This means you’re reporting on your income as soon as an invoice is raised and a bill is received (regardless of how long either takes to be paid).

Benefits of cash vs accrual accounting

Now this all might sound boring with a capital B but let me tell ya, IT’S IMPORTANT.

As they say, the devil is in the details and here’s why:

If you or your bookkeeper is reporting on your finances on an accrual basis when it comes to your BAS bills, there’s a good chance you’re paying tax (GST) on income you haven’t actually received yet. Think about an invoice that doesn’t get paid for 8 months. NOT IDEAL.

This has the potential to lead to cash flow problems. But here’s where things get a little complicated.

Accrual basis accounting may suck eggs when it comes to BAS bills but when it comes to making important financial decisions in your business (like new hires, big equipment purchases, etc) it’s far better for understanding your financial position.

It allows you to see the full picture of your business’ performance, not just what has been paid or received. For example, you might have $80K in your business bank account, which might sound great, right? But by looking at things this way, you could be completely overlooking the fact that you have $140K in supplier invoices due next week.

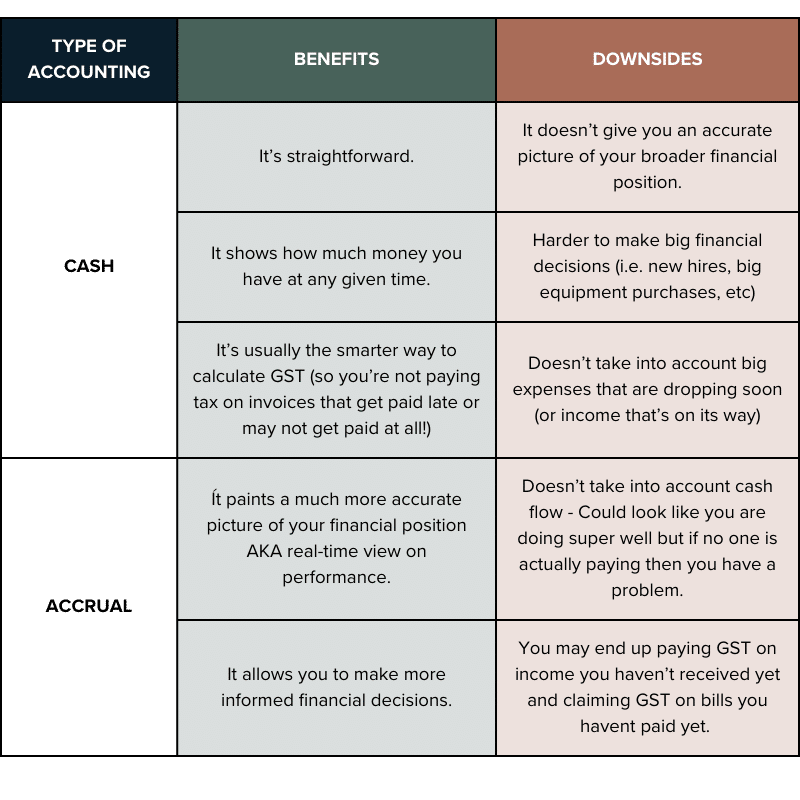

In short? We like both methods for different reasons. See below for a full breakdown of the pros and cons of cash vs accrual accounting:

Ready for some good news?

You can use both methods*! Year-end tax will always be completed on an accrual basis but when it comes to BAS bills – you can make the choice between cash and accrual. It’s best to talk through what will be best for you with a pro.

*If your business has an annual turnover greater than $10 million and/or your annual GST turnover is more than $2 million, you must use accrual basis accounting.

Have I mushed your brain? Reckon you could do with a friendly hand to help you get your head around your numbers? Check out our Power Hour service here.