Scrunchers and folders are always at odds, but when it comes to a glove box full of discarded receipts, our message to you remains the same — don’t throw them out!

If you run a business — and don’t particularly enjoy financial headaches — you’ll be needing them.

Yep, those annoying bits of paper cluttering up your car (or wallet) serve a purpose. And an important one at that. Come tax time or when your next BAS is due, you’ll be ripping your hair out if you don’t have an adequate paper trail for your business buys.

So, what proof of purchase does your business need to keep your records in tip-top shape? And why does it really matter? Allow me to explain.

Why does your business need to keep proof of purchase records?

First things first. Those flimsy little receipts contain information you need for declaring your expenses to the ATO.

You may not believe it but the ATO does randomly audit businesses to check that you can prove you purchased the expenses you said you did.

And if you fail an ATO audit you will be penalised (likely financially) and it will be a stressful, time-consuming and all-around pain. So keep those receipts!

Avoiding the wrath of the ATO (or your bookkeeper) isn’t the only good reason to keep your proof of purchase records in order, though.

Keeping your receipts will give you a better understanding of how your business is performing. When you know how much you’re spending and what you’re spending it on, you can make better business decisions.

You’ll also be able to identify fraudulent activity much faster. It’s honestly a win-win!

What types of receipts do you need to keep?

I’m sorry to break this to you but yes, there are types of receipts. And some of them are more important than others.

EFTPOS Receipts

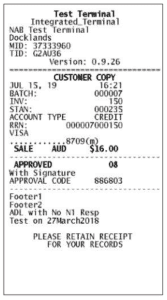

An EFTPOS receipt shoots out of an EFTPOS machine (go figure) and looks something like this.

It’s the type of receipt you’ll probably be most familiar with. But it (sadly) doesn’t provide enough detail for tax compliance.

Tax Invoices

This stuff is what bookkeepers froth over. A tax invoice receipt provides ALL the juicy deets needed to ensure the ATO doesn’t yell at you.

According to the ATO, these are the 7 items that need to be included on a tax invoice:

- Document is intended to be a tax invoice

- Seller’s identity

- Seller’s Australian business number (ABN)

- Date the invoice was issued

- Brief description of the items sold, including the quantity (if applicable), and the price

- GST (if any) payable — this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, as a statement that says ‘Total price includes GST

- The extent to which each sale on the invoice is a taxable sale

How to manage your record keeping

As soon as you receive your receipts, DON’T shove them in your pocket or file them away in a box somewhere to be long forgotten.

It’s time to get digital, baby. We highly recommend (as in, cannot recommend enough), snapping a photo of it on your phone and using some kind of filing software like Dext Prepare.

We use these for all of our clients because they make everyone’s lives super easy.

Ready to let go of your own bookkeeping and get into your genius zone? Our services are right this way.

Get out of your books and into a cool car or something

Hey good-bookin’, whatcha got cookin’?

Thrilling Privacy Policy | Mind-Blowing Terms and Conditions © 2021 OH NINE. All Rights Reserved.

Copy created by Readcity Writing | Website by Elise McGregor