I know simply thinking the words “business tax” is probably enough to make your stomach do a backflip (and not in a happy way), but I’m about to add another sweat-inducing term to your vocab.

Business activity statements (BAS)

If your business is registered for GST (which needs to happen when your business earns over $75,000 before tax), then BAS is about to become a regular (and annoyingly important) part of your life.

So strap yourself in and allow me to explain exactly what they are.

But first, a quick side note:

Should your business be registered for GST?

If your business generates more than $75,000 in sales you need to register for GST. It’s the law of the land.

But even if your business doesn’t make over $75,000 yet registering for GST may still be worthwhile.

Why could registering for GST be a smart move for you (even if your business isn’t making $75,000 yet)?

- If you’re confident you’ll be hitting $75,000 annually in sales sooner rather than later, it often makes more sense to get everything set up in one go.

For example, if you’ve already got a bookkeeper on board to help you set up your accounting software or payroll, it will likely be cheaper to get them to register you for GST now rather than re-engaging their services in 6 months time. - It’s less of a shock for your customers.

It’s never all that fun communicating a price increase to a current client. If you’re registered for GST from the start you can avoid the unwanted scenario of landing a new client, then suddenly needing to increase their bill because you’ve hit the GST threshold.

What is a business activity statement?

Okay, I was riling you up a bit – BAS isn’t all that complicated.

In short, BAS is a form you need to submit to the ATO either monthly, quarterly or annually (depending on how big your business is).

This form lets the ATO know how much you’ve collected and paid in GST, as well as:

- Pay as you go instalments (PAYG-I) – tax obligations related to your business income

- Pay as you go withholding (PAYG-W) – tax obligations related to your employees personal income

If you’re scratching your head wondering what the heck that all means, I don’t blame ya. Watch the video below for a quick and easy explainer.

It can also include the following – although, these aren’t applicable to the vast majority of our clients – so we won’t be going into detail on these today:

- Fringe benefits tax (FBT)

- Luxury car tax (LCT)

- Wine equalisation tax (WET)

The ATO uses this info to work out if you owe them money or if they need to dole you out a refund, so you could say it’s kinda pretty important.

What information do I need to complete it?

To submit your BAS, you’ll need to keep track of how much GST was paid to you in sales and how much GST you spent on purchases in your business. And *ahem* this is where having a bookkeeper comes in handy.

The point of BAS is to help you stay on top of your income and expenses, as well as any other tax liabilities you have (which is a fancy way of saying the amount of tax debt you owe).

And just a heads up, you aren’t required to send through your tax invoices as evidence, but it’s a good idea to have them ready (should the ATO decide they need to see them).

How do I lodge my BAS?

Thank god for the internet! You don’t have to submit physical forms anymore, it’s all done online. Yew!

You have a few options when it comes to lodging your BAS.

- Hire a BAS agent or bookkeeper to do it for you

- Do it through your online accounting software (we use Xero)

- Individuals and sole traders can use myGov

- Businesses and other organisations can use the ATO’s online services for business

When are the BAS due dates?

Don’t worry about having these dates ingrained in your brain – just add them to your calendar as a reminder to get your sh*t organised.

The great thing about BAS is that ATO will tell you (on your form) when you need to lodge and submit payments. It’s also worth noting that in some cases when you lodge online, you might be eligible for an extra two weeks.

Monthly

If your GST turnover crosses the threshold of $20 million, then you need to lodge BAS on a monthly basis (aka 12 times a year).

Your BAS is due to be lodged and paid within 21 days after the end of the month. So, if you’re completing your BAS for September, it’ll need to be lodged and paid by the 21st of October.

Quarterly (psst! This is probably you)

If your GST turnover is less than $20 million and the ATO hasn’t told you to lodge monthly, then you need to lodge quarterly.

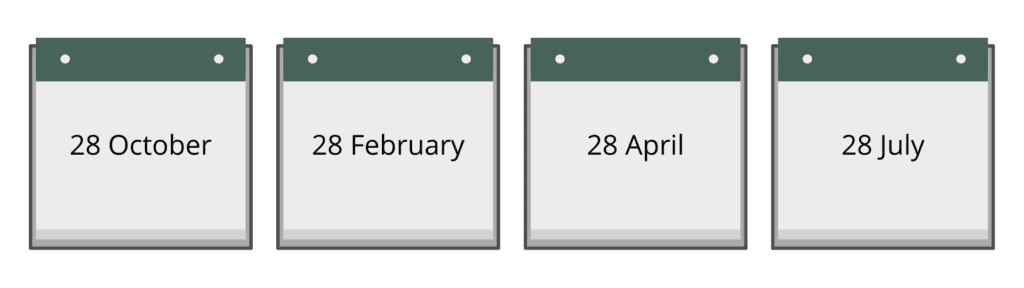

These are the dates you’ll wanna pop on your calendar.

One extra detail worth noting here – and I’m sorry, I know how ridiculously confusing this might sound – is if you withhold over $40,000 in PAYG-W (tax obligations related to your employees personal income) you’re required to pay this to the ATO on a monthly basis, in what is called an instalment activity statement (IAS).

I know, I know. Another freaking statement. If you’re feeling lost (and I most certainly wouldn’t blame you), book in for a free chat with me here. I’d love to help you figure out what applies to your business and what doesn’t so you can breathe easy.

Annually

You will need to report annually if you’ve registered for GST and your GST turnover is less than $75,000 (or $150,000 for not-for-profits).

You can submit your BAS with your yearly income tax return. This is due by October 31.

Feeling a tad overwhelmed by BAS? We’ve got your back. You can book a virtual beer with us and chat all things BAS here.

Get out of your books and into a cool car or something

Hey good-bookin’, whatcha got cookin’?

Thrilling Privacy Policy | Mind-Blowing Terms and Conditions © 2021 OH NINE. All Rights Reserved.

Copy created by Readcity Writing | Website by Elise McGregor